2025 Roth Ira Contribution Limits 2025 Married Filing. If you are 50 and older, you can contribute an additional $1,000 for a total of. The remaining weeks of the year are a.

Whether you can contribute the full amount to a roth ira depends on. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older).

If You Are 50 And Older, You Can Contribute An Additional $1,000 For A Total Of.

If you are 50 or older by the end of 2025, you may contribute up to $8,000 to a roth ira.

How Much You Can Contribute Is Limited By Your Income Level,.

12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2025 to contribute.

Qualified Roth Ira Distributions Are Not Subject To Income Tax Or Capital Gains Tax.

Images References :

Source: allyqlilllie.pages.dev

Source: allyqlilllie.pages.dev

2025 Roth Ira Limits Phase Out Beckie Rachael, Published 1:53 pm edt, mon november 13, 2023. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

Source: klarrisawbriney.pages.dev

Source: klarrisawbriney.pages.dev

When Can I Contribute To Roth Ira 2025 Daisi Celeste, Whether you can contribute the full amount to a roth ira depends on. The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

Source: choosegoldira.com

Source: choosegoldira.com

ira contribution limits 2022 Choosing Your Gold IRA, In 2025, you can contribute a maximum of $7,000 to a roth ira. The roth ira contribution limit for 2025 is $7,000, or $8,000 if you’re 50 or older.

Source: jolettawcarey.pages.dev

Source: jolettawcarey.pages.dev

What Are The Ira Limits For 2025 Margo Sarette, The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Source: rosaqselestina.pages.dev

Source: rosaqselestina.pages.dev

Tax Free Limit 2025 Farra Jeniece, 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2025 to contribute. Qualified roth ira distributions are not subject to income tax or capital gains tax.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Roth IRA Contribution Limit 2025 2025 Roth IRA Contribution Limits in, To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year). This is up from the ira.

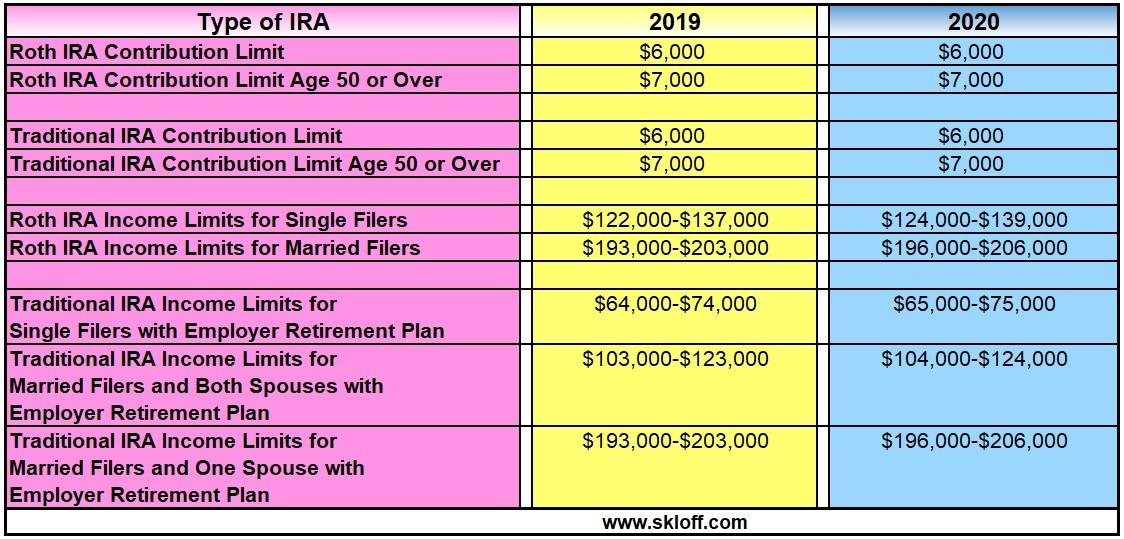

Source: skloff.com

Source: skloff.com

IRA Contribution and Limits for 2019 and 2020 Skloff Financial, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older). The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Source: thestockmarketnews.com

Source: thestockmarketnews.com

Calculating Roth IRA 2023 and 2025 Contribution Limits The Stock, The remaining weeks of the year are a. In 2025, you can contribute a maximum of $7,000 to a roth ira.

Source: buffyqmorgan.pages.dev

Source: buffyqmorgan.pages.dev

Roth Limits 2025 Theo Ursala, If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or. Fact checked by kirsten rohrs schmitt.

Source: ee2022d.blogspot.com

Source: ee2022d.blogspot.com

2022 Ira Contribution Limits Over 50 EE2022, For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. If you are 50 or older by the end of 2025, you may contribute up to $8,000 to a roth ira.

For Taxpayers 50 And Older, This Limit Increases To $8,000.

If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or.

Qualified Roth Ira Distributions Are Not Subject To Income Tax Or Capital Gains Tax.

David tony, cnn underscored money.