Hhsa Limits 2024 Include Employer Contribution. How much can be contributed to an hsa each year? The health savings account (hsa) contribution limits increased from 2023 to 2024.

The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. For 2024, you can contribute up to $4,150 if you have individual coverage, up.

The Maximum Amount Of Money You Can Put In An Hsa In 2024 Will Be $4,150 For Individuals And $8,300 For Families.

Considerations for 55+ employees in 2024.

Health Savings Accounts Are Already An Unsung Hero Of Saving Money In.

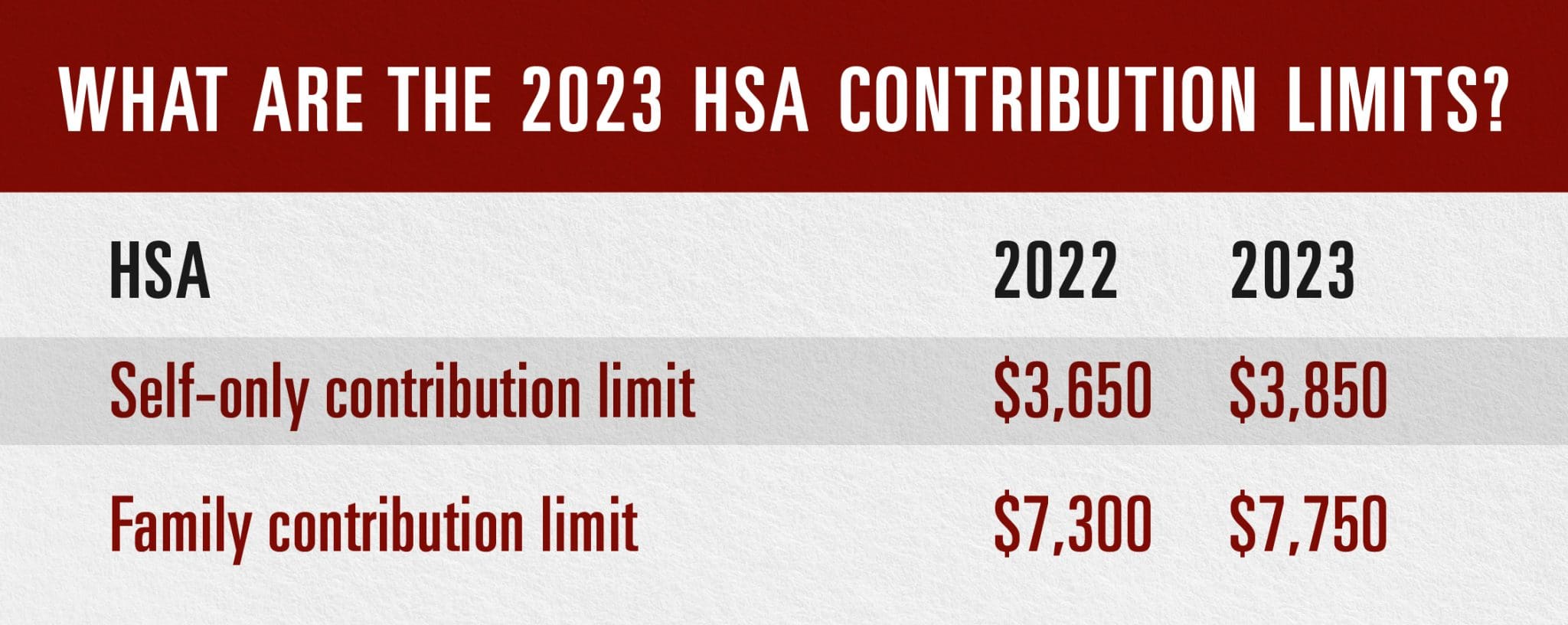

The maximum contribution for an hsa in 2024 is $4,150 for an individual ($3,850 for 2023) and $8,300 for a family ($7,750 in 2023).

Hhsa Limits 2024 Include Employer Contribution Images References :

Source: gayleenwelaina.pages.dev

Source: gayleenwelaina.pages.dev

2024 Contribution Limits For Hsa Rae Leigha, The health savings account (hsa) contribution limits increased from 2023 to 2024. Below are all hsa contributions including your contributions, employer contributions, and maximum.

Source: yettyqmarlie.pages.dev

Source: yettyqmarlie.pages.dev

Hsa Contribution Limits In 2024 Tanya Eulalie, Hsa contribution limits for 2024. How much can be contributed to an hsa each year?

Source: imagetou.com

Source: imagetou.com

Hsa Contribution Limits For 2023 And 2024 Image to u, On may 9, 2024 the internal revenue service announced the hsa contribution limits for 2025. Health savings accounts are already an unsung hero of saving money in.

Source: www.claremontcompanies.com

Source: www.claremontcompanies.com

2024 HSA Contribution Limits Claremont Insurance Services, The health savings account (hsa) contribution limits effective january 1, 2024, are among the largest hsa increases in recent years. Employer contributions count toward the annual hsa.

Source: darellbmalynda.pages.dev

Source: darellbmalynda.pages.dev

Hsa Contribution Limits 2024 Employer Contribution Aggy Lonnie, So, if you’re planning to make additional contributions to your hsa in 2024, or you’re thinking about signing up for an hsa in 2025 and want to know how. Health savings accounts are already an unsung hero of saving money in.

Source: jonathanhutchinson.z21.web.core.windows.net

Source: jonathanhutchinson.z21.web.core.windows.net

401k 2024 Contribution Limit Chart, The health savings account (hsa) contribution limits increased from 2023 to 2024. The health savings account (hsa) contribution limits effective january 1, 2024, are among the largest hsa increases in recent years.

Source: www.wexinc.com

Source: www.wexinc.com

2023 HSA contribution limits increase considerably due to inflation, Considerations for 55+ employees in 2024. Hsa limits 2024 include employer contributions hsa limits 2024 include employer contributions.

Source: betteannewjill.pages.dev

Source: betteannewjill.pages.dev

401k Employer Contribution Deadline 2024 Lotta Diannne, The hsa contribution limit for family coverage is $8,300. The health savings account (hsa) contribution limits increased from 2023 to 2024.

Source: advantageadmin.com

Source: advantageadmin.com

2023 HSA contribution limits increase considerably due to inflation, The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. Hsa contribution limits for 2023 are $3,850.

Source: veronikewgisele.pages.dev

Source: veronikewgisele.pages.dev

Irs 401k Limits 2024 Over 50 Kelli Madlen, So, if you’re planning to make additional contributions to your hsa in 2024, or you’re thinking about signing up for an hsa in 2025 and want to know how. The health savings account (hsa) contribution limits increased from 2023 to 2024.

So, If You’re Planning To Make Additional Contributions To Your Hsa In 2024, Or You’re Thinking About Signing Up For An Hsa In 2025 And Want To Know How.

Health savings accounts are already an unsung hero of saving money in.

Considerations For 55+ Employees In 2024.

The health savings account (hsa) contribution limits increased from 2023 to 2024.

Category: 2024